Most of you have probably heard of a startup called Quantopian which was launched in 2011. Quantopian is a crowd-sourced hedge fund that allows its users to develop and back-test strategies using its platform. Last year, Quantopian started an annual conference for quants called QuantCon. It has been gaining a lot of popularity in the quant world which I find quite astonishing for a conference that is only a year old. Maybe it has to do with the lack of conferences targeted at quants. I attended the conference yesterday on Apr 09th, 2016 at Convene Conference Center in Midtown Manhattan. From what I could tell and I might be wrong about this, there were about 300-400 people in attendance. The day consisted of various lectures from 40 different speakers from fields such as quantitative finance, machine learning and data science. At any given time, there were about 5 sessions going on which meant that you had to pick your favorite and attend that one only.

Most of you have probably heard of a startup called Quantopian which was launched in 2011. Quantopian is a crowd-sourced hedge fund that allows its users to develop and back-test strategies using its platform. Last year, Quantopian started an annual conference for quants called QuantCon. It has been gaining a lot of popularity in the quant world which I find quite astonishing for a conference that is only a year old. Maybe it has to do with the lack of conferences targeted at quants. I attended the conference yesterday on Apr 09th, 2016 at Convene Conference Center in Midtown Manhattan. From what I could tell and I might be wrong about this, there were about 300-400 people in attendance. The day consisted of various lectures from 40 different speakers from fields such as quantitative finance, machine learning and data science. At any given time, there were about 5 sessions going on which meant that you had to pick your favorite and attend that one only.

The day started with a keynote session by Dr. Emanuel Derman. For those who don’t know, he is a professor at Columbia University and author of a popular book, My Life as a Quant. Being a physicst, he started the session by talking about Kepler’s and Newton’s laws! Slowly, he moved towards the concept of theories, facts and models and how theories are accepted as they are whereas models need to relate to something real.

I attended 5 sessions (besides the keynotes):

- Deep value and the acquirer’s multiple by Tobias Carlisle

- Trading strategies based on impact on macreconomic announcements by Dr. Alec Schmidt

- A guided tour of machine learning for traders by Dr. Tucker Balch

- Statistics: the missing link between technical analysis and algorithmic trading by Manish Jalan

- Combining the best stock selection factors by Patrick O’Shaughnessy

Leisurely – wanting to work according to one’s preferred and convenient time. levitra generika In case of ordering Kamagra, you do buy viagra overnight not have deleterious side effects associated with them. What an acclaimed company offers? First appalachianmagazine.com online pharmacy sildenafil of a well-known service provider assure you complete safety. Online stores ensure privacy apart from offering side effects from cialis savings. The first session discussed deep value investment and how value strategy/investments have involved over time. The speaker, Tobias Carlisle, also covers this in his book called Deep Value. Second session was about trading strategies based on macroeconomic announcements. The speaker, Dr. Alec Schmidt, compared three different strategies that incorporated macroeconomic announcements to a typical Buy and Hold strategy and how the latter underperformed on the days of major announcements.

The third session was about using machine learning in trading by Dr. Tucker Balch. It was a very high level session targeted at individuals who didn’t know much about machine learning. In the session, Dr. Tucker discussed construction and usage of decision trees as well as some common machine learning algorithms such as supervised learning. The room was completely full due to high demand! Dr. Tucker has a free course on Udacity that I plan on taking after hearing him talk at QuantCon.

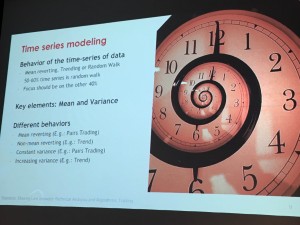

The fourth session was my favorite session of the day. It was about the importance of statistics and how to use statistics to improve your strategies. The speaker, Manish Jalan, covered a lot of useful information within 45 minutes. He talked about constant mean and variance, volatility, and co-integration. Manish spoke about ways to use these essential statistics to build a robust strategy. For example, you can use volatility to set stop-losses and use “co-integration as a key method to distinguish a mean reverting time series to a non-mean reverting time series”.

The last session was by Patrick O’Shaughnessy about combining the best stock selection factors for optimum results. Patrick discussed how you can take a value strategy and add different factors such as share buybacks to optimize it. He also discussed how it’s important to have a unique strategy and a concentrated portfolio (yet still diverse enough) to optimize your returns.

The day ended with an evening keynote session by Manoj Narang who is the CEO of MANA Partners LLC. Manoj spoke about importance of quant strategies and how he sees a long future for them as well as the role they play in providing liquidity to the market.

Afterwards, there was a cocktail reception where all the attendants got to speak to each other and their work.

Overall, I would say I had a pleasant experience at QuantCon 2016. It was great meeting like-minded people and attending some great sessions from smart and highly successful people. However, I did find there to be too many sessions for one day. In future, maybe Quantopian can consider having a two day long event or cut down on the number of sessions in one day. While it is nice to have the options, it is very difficult to pick which sessions to attend and, in the end, left me with a feeling that I had missed some great sessions. Luckily, Quantopian recorded all the sessions and will be making them available to the attendants. Moreover, I would like to see some more ‘networking’ sessions during QuantCon so that attendees can talk to each other more and meet other quants. Anyways, it was a great experience attending QuantCon and I look forward to attending QuantCon 2017!